Parker Range Iron Ore Project

On 4 August 2011, the Company announced a conditional sale and an alliance arrangement over the Parker Range Iron Ore Project.

Cazaly agreed on commercial terms and signed a Heads of Agreement for the sale of its Parker Range Iron Ore Project to a major South East Asian diversified investment group (“Investment Group”)

The Agreement allowed for the payment of an initial $40M within 6 months of the execution of a formal Sale and Purchase Agreement (“SPA”) (which could be extended by mutual agreement) and a further payment of $55M upon the earlier of first iron ore being exported or 24 months from signing of the SPA. In addition, a royalty of $2.50 per tonne was payable on all ore produced. The per tonne royalty rate is capped at a maximum of 10% of the gross profit margin should that calculation be lower than $2.50 per tonne.

It was also intended that the parties enter into a 50/50 jointly funded regional exploration agreement, whereby Cazaly would manage all ongoing exploration, including over the Parker Range tenements, within the greater Parker Range region.

Hamersley Iron Ore Project JV

Cazaly reducing to 49% – Winmar Resources Ltd earning an initial 51% interest.

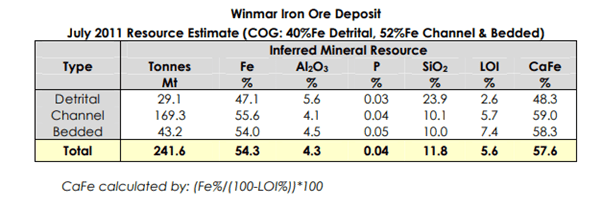

Winmar Resources Limited (ASX:WFE) in conjunction with Cazaly Resources announced a new Inferred Resource Estimate for the Winmar Deposit at the Hamersley Iron Ore Project following completion of a 93 hole / 12,805m drill programme. The estimate was based on results received from the RC drilling extension and infill program completed in May 2011.

The project lies approximately 50km NE of the Tom Price township in the Pilbara Region of Western Australia, was well placed amongst existing infrastructure and lies immediately south of FMG’s Solomon project.

An Order of Magnitude Study utilizing the expertise of Engenium Consultants, commenced to investigate the development options of the Winmar Deposit. This new resource estimate and exploration target would be used in the study.

A programme of PQ Diamond Core drilling commenced at Winmar to obtain samples to commence metallurgical testwork.

The Company granted Winmar an option to purchase 100% interest in the Hamersley iron ore project for an exercise price of $35 million and the grant of a royalty. Winmar paid an option fee of $100,000 for the one-month option but it subsequently lapsed.

Earaheedy Iron Ore Project (Cazaly Resources 50% / Vector Resources 50%)

Significant drill results were returned from a maiden drilling programme at the Earaheedy Project, northeast of Wiluna, WA.

The Earaheedy Project is a 50:50 Joint Venture with Vector Resources Limited (ASX: VEC).

The drilling programme comprised 21 holes for 1,916m, testing a number of targets at the Project with highly encouraging results coming from the Cecil Rhodes Prospect. Significant results from the prospect include 34m @ 54.4% Fe (including 22m @ 58.1% Fe), 22m @ 57.8% Fe and 26m @ 55.1% Fe, all with low levels of contaminants.

Whilst very early days, the Company was encouraged by the results which highlighted the potential of the Joint Venture’s portfolio to host large-scale iron ore deposits. Numerous targets elsewhere in the Project remain to be drill tested.

The Joint Venture partners were currently planning programmes for 2011 including further mapping of the mineralised horizon at Cecil Rhodes and developing follow-up drill programmes.