Halls Creek (CAZ 100%)

The project is situated 25km southwest of Halls Creek and covers part of the Halls Creek Mobile Zone which is highly prospective for a range of commodities including copper, gold, and nickel. The project includes the Mount Angelo North copper-zinc deposit, an extensive zone of near surface oxidised Cu-Zn mineralisation overlying massive Cu-Zn sulphide mineralisation.

As announced on 16 August 2022, RC drilling was completed at the Halls Creek project. A total of 19 holes were drilled for 4,049m to test the Moses Rock EM conductor and the Bommie Porphyry Copper System.

The Bommie prospect is located 2.5km southwest of Mount Angelo North and is interpreted as a large low grade copper system with significant drill intercepts. The prospect has an extensive surface geochemical signature which provides further encouragement for a large mineralised system. All priority drill holes were completed. A decision to complete the second priority drill holes will be made following the receipt of all assay results and the estimation of a maiden inferred mineral resource. Sampling techniques and data collection are detailed in the Cazaly announcement dated 16 August 2022.

In June 2021, the Company completed eight (8) RC holes with one (1) diamond tail drillhole (per 31 August 2021 ASX announcement) at the Mount Angelo North Cu-Zn deposit to confirm the continuity of shallow copper mineralisation and test potential extensions to known sulphide mineralisation along strike and down dip.

The RC drill results were received during the financial year and confirmed good, consistent high-grade Cu-Zn mineralisation and marginally extended the known limits of the deposit. The drilling, and recent remodeling also highlighted a potential new down plunge position for Zn mineralisation.

A significant amount of work has been completed to advance our understanding of the Mount Angelo North deposit. The mineralised envelope was re-modelled based on geological observations and weathering profiles and confirms the robust nature of the shallow oxide copper mineralisation near surface, with growth potential down dip and down plunge.

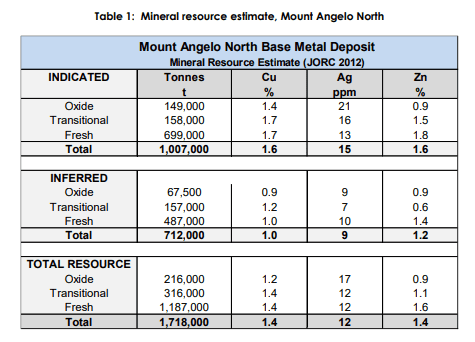

The resource was updated using the newly interpreted mineralisation model and re-estimated to comply with JORC Code 2012. The Mount Angelo North mineral resource estimate detailed in the table below, is reported as 1.72Mt @ 1.4% Cu, 12.3ppm Ag, 1.4% Zn (using 0.4% Cu lower cut) for 23kt Cu, 680koz Ag and 25kt Zn.

Ashburton Basin Project (CAZ 100%)

Cazaly holds the rights to a major land position covering more than 2,450km2 in the Ashburton Basin, in the Pilbara region of Western Australia. The project covers major regional structures considered to be highly prospective for major gold mineralisation and occurs in the region hosting Black Cat Syndicate’s (ASX: BC8) Paulsen’s gold deposit and Kalamazoo’s (ASX: KZR) Mount Olympus gold deposit.

The Ashburton Basin forms the northern part of the Capricorn Orogen, a ~1000km long, 500km wide region of variably deformed metamorphosed igneous and sedimentary rocks located between the Yilgarn and Pilbara cratons.

The Company applied for tenure within the region following the recognition of the presence of major deeply seated, crustal scale structures with the potential to host significant mineralisation eg. the Baring Downs Fault. The Baring Down Fault lies centrally within the Ashburton Basin which has previously had very little modern exploration.

Heritage agreements for the final tenement application in the Ashburton package were finalised and E08/3262 was granted on the 7 December 2021. The Ashburton tenement package now includes five (5) leases – E08/3260, 3261, 3262, 3265 and 3272.

Vanrock Polymetallic Project (Option to earn in)

The Vanrock project is located in central north Queensland 350km west of Cairns within the northern portion of the Townsville-Mornington Island Igneous Belt (TMIB), which extends over 700km from Townsville to the Gulf of Carpentaria. The project area is located where the TMIB dips undercover, and is relatively poorly explored, especially when compared to the extensive exploration activities to the southeast where the TMIB is exposed at surface, this is evidenced by the abundant mineralisation occurrences within the TMIB to the southeast. The Project is considered to have potential for Andean-type silver-tin-zinc-copper-lead mineralisation.

Cazaly entered into an agreement with Lynd Resources Pty Ltd to acquire a majority stake in the Vanrock project based upon the terms outlined in the ASX announcement dated 20 July 2022. Cazaly will fund the drilling of a single diamond drill hole as an Option before electing to progress any further with the joint venture.

A heritage survey was conducted on the 24 to 26 August 2022 to ensure no heritage places or sites would be disturbed during future earthworks and drilling activities.

As announced on 7 September 2022, preliminary results were received for an airborne Electromagnetic (EM) survey completed in early August 2022 across the Vanrock Project using XciteTM, a high-resolution helicopter borne time domain electromagnetic and magnetic survey system. Eight lines were completed in total for 40km on a 500m line spacing. 4 lines were completed across the Vanrock target, and 4 lines were completed across a lookalike target on EPM27085 located 10km to the southeast of the Vanrock Target.

Diamond drilling commenced early in September and the single diamond drill hole was completed to 521.5m depth (as announced 21 September 2022). Two separate semi-massive sulphidic zones were intersected from 211.95m to 215.96m and 264.3m to 272.54m down hole. Potassic alteration associated with the sulphidic zones also occurred sporadically throughout the drill hole.

Yabby (CAZ 100%)

The Yabby tenements are located 10km to the west of Laverton in the north-eastern goldfields of Western Australia. The project area covers 16km2 of the highly prospective Laverton Greenstone Belt and has potential for new gold discoveries. Tenements are positioned directly west of the Chatterbox shear zone host to several gold mines currently owned by Focus Minerals. In addition, the Lady Julie gold deposit, located along strike to the south, shows encouraging signs for a newly emerging mining centre with gold mineralisation extending from surface with recent drill results including 22m @ 4.1 g/t Au from surface, and 16m @ 5.59 g/t Au from 20m (ASX: MAU, Magnetic Resources NL announcement dated 10 January 2022).

In July 2022, Cazaly received analytical results for 246 samples collected during the June ’22 quarter. Surface samples were collected on a 200m x 50m grid across anomalous gold in lag trends, identified by the initial 400m x 200m sampling programme completed in the December ’21 quarter.

Several N-S and NNE gold mineralised trends were identified in the first pass reconnaissance surface samples, and this follow up phase of infill surface sampling has refined these anomalies to generate discrete gold anomalies. The orientation of the refined gold mineralised trends is analogous to the adjacent Chatterbox shear zone host to Apollo, Whisper & Eclipse gold deposits mined by Focus in the 2010’s. This provides further encouragement that these surface anomalies reflect gold in the bedrock beneath.

Refer to ASX Announcements dated 28 March 2022 and 25 July 2022 for anomalous assays, sampling techniques and reporting of results.

Kaoko Kobalt Project (CAZ 95%)

Cazaly holds a 95% interest in the Kaoko base metal project located in northern Namibia approximately 800km by road from the capital of Windhoek and approximately 750km from the port of Walvis Bay. The project is situated immediately north of, and abuts, Celsius Resources Limited’s (ASX: CLA) Opuwo Cobalt project with a current resource of 225Mt @ 0.12% Co & 0.43% Cu (CLA ASX: 16 April & 5 November 2018).

A lithium in soil anomaly measuring 12km x 10km located in the north-eastern portion of the tenement requires further investigation. High priority Co-Cu targets will be re-assessed in conjunction with a full commodity evaluation using all available datasets with a view to advancing the project.

Mt Venn Joint Venture Project (WML 80% CAZ 20%)

The Mt Venn gold project is located 125km northeast of Laverton in the North-eastern Goldfields region of Western Australia and covers approximately 400km2 of prospective greenstone sequence. The project area lies within the Mount Venn-Yamarna-Dorothy Hills greenstone belt which is the most easterly major N-S striking greenstone belt of the Yilgarn Craton.

The belt is considered highly prospective for gold and nickel and is positioned along the western limb of the Yamarna Greenstone Belt that hosts Gold Road’s and Gold Fields’ 6Moz Gruyere Gold Mine. Together the Yilgarn greenstone belts account for 30% of the world’s gold reserves, most of Australia’s nickel production and other base metal and rare earth deposits.

The project is subject to an unincorporated Joint Venture between the operators Woomera Mining Limited (Woomera, ASX: WML) (80%) and Cazaly (20%). Cazaly is free carried to PFS stage.

McKenzie Springs Joint Venture (FIN 70% CAZ 30%)

Sammy Resources Pty Ltd (a wholly owned subsidiary of Cazaly) is in joint venture with Fin Resources Ltd (ASX: FIN) over exploration licence E80/4808, the McKenzie Springs project, located in the Kimberley region of Western Australia. The project lies south along strike from the Savannah nickel mine owned by Panoramic Resources Ltd and is prospective for intrusive – hosted nickel copper mineralisation.

Parker Range Iron Ore Project (MIN 100% – CAZ royalty interest)

Mineral Resources Limited (ASX: MIN) continued production at the Parker Range mine and has reduced the hauling distance from the mine by 60km. Cazaly retains a royalty of $0.50/tonne of iron ore produced from Parker Range after the first 10 million tonnes of production.

Hamersley Iron Ore Project

The Hamersley Iron Ore Project was an unincorporated Joint Venture between Lockett Fe Pty Ltd (Lockett) (100% owned subsidiary of the Company) and Pathfinder Resources Ltd (ASX: PF1). During August 2021 the project was sold to Equinox Resources Limited (ASX: EQN) who successfully completed a $9 million initial public offering under its Prospectus dated 31 August 2021 and subsequently listed on ASX on 13 October 2021. Lockett received 15,000,000 EQN shares and 2,850,000 performance shares, plus the Company also retained a royalty interest on the project.

Equinox Resources Limited continued to advance feasibility studies to progress the development planning at the Hamersley Iron Ore Project where the Company retains a 15.7% equity interest in EQN and a royalty interest of US$0.30/tonne produced from the project. The project is located in the heart of the world-renowned Pilbara iron ore district and currently has a total Mineral Resource estimate of 343.2 Mt at 54.5% Fe (per Pathfinder (formerly Winmar) Resources Ltd ASX announcement dated 24 January 2020).

Jonathan Downes – New Independent Non-Executive Director

As announced on 19 November 2021, the Company appointed Mr Jonathan Downes as a new independent Non-Executive Director, whilst Mr Nathan McMahon vacated his role as Non-Executive Director on 7 March 2022.

After a long and successful history with Cazaly, the Board welcomed the appointment of Mr Clive Jones into the role of Chairman.